Focused on their feelings, fears, priorities and coping mechanisms, it is a striking snapshot as the nation looks ahead to what will be an incredibly tough winter for many.

The study, conducted in partnership with research company 56 Degree Insight, shows biggest shift in Scottish consumer confidence in living memory with nine out of ten Scots seriously concerned by the cost of living crisis.

The findings make for sober reading, indicating that perhaps there is a disconnect between the reality of public sentiment and the current consensus amongst legislators, retailers and consumer brands.

The report strongly suggested that there is now a sense of ‘permacrisis’ taking hold amongst the general population; the pandemic, Brexit, inflation, Ukraine, Westminster instability and the energy crisis have all created a poisonous, potent and toxic cocktail for the average Scot.

The key findings

- Spike in national anxiety and stress: 89% of people living in Scotland expressed serious concerns about the cost of living. 69% reported economic anxiety impacting on mental health including more than a third struggling to sleep at night.

- Scots having less fun?: Scots are drinking less as they cut back, by almost 25%, and 21% are gambling less. Interestingly, 26% of Scots report that they are having less sex. It would seem this economic crisis really is a buzz killer.

- A nation consumed by worry: 54% Scots worrying to a major extent on how to pay bills and over four in ten significantly worried on how to put food on the table.

- Cut-backs and delays: Families are significantly cutting back, with 88% of households earning £30-£40K the most concerned by rapid increases in outgoings. Cost cuttings include spending less on new clothing (55%), delaying holiday decisions (45%) and eating out less (57%). 39% expect to spend less on Christmas gifts.

- Personal care takes a hit as wallets tighten: 37% will get their hair cut less and less cosmetic procedures like botox and fillers (11%, rising to 21% in image conscious Southern Scotland).

- Changing behaviour: 80% of women were changing shops (some or all of the time) and 88% are shifting to less expensive products and brands.

Conducted in the aftermath of the autumn’s mini-budget and economic crisis by 56 Degrees Insight, it is the largest specific survey of its kind solely focused on people living in Scotland. The survey of over 1,000 people, found the cost of living crisis had a shockingly negative impact on Scots.

Shifts in attitudes and behaviour

In fact, the data is so pronounced that it indicates the single biggest shift in consumer anxiety and shopping behaviours in living memory. Because, unlike the pandemic, people can’t, or are too fearful, to splurge.

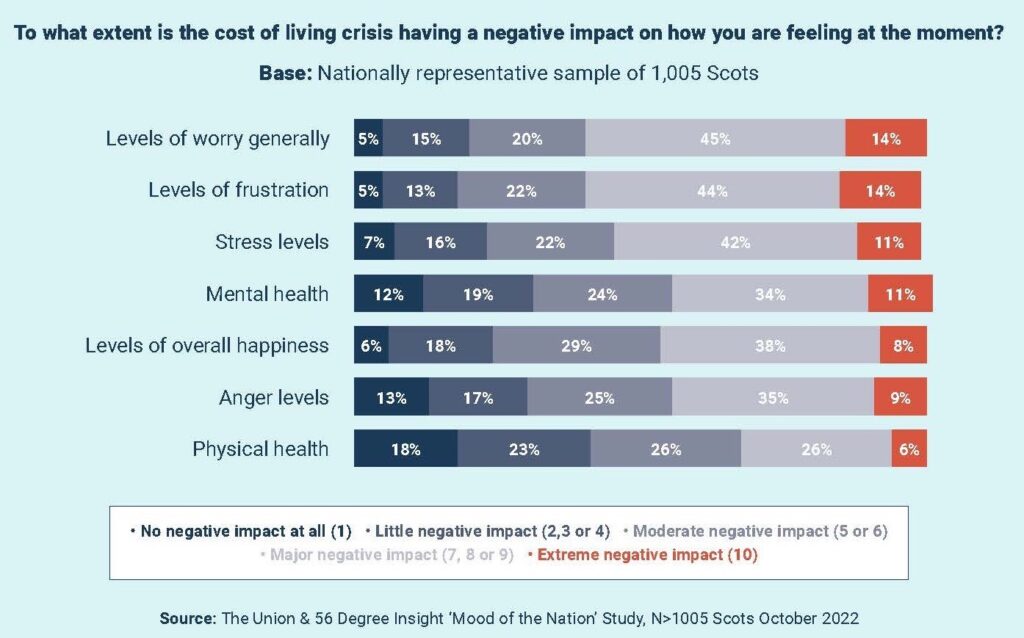

For instance, people report impacts to their stress levels (75%), mental health (69%) and levels of optimism about the future are now 57% lower than during the depressing resurgence of the pandemic in 2021.

Anger and frustration on the rise

Worryingly for many households, especially with vulnerable women and children, levels of ‘anger’ (69%) and ‘frustration’ (80%) have skyrocketed due to the recent crisis. It follows that this could lead to a spike in domestic abuse, especially during Christmas, which is going to be markedly more tense and frugal this year.

With anger comes blame, and there are many targets for blame, including energy companies, the UK Government, war in Ukraine, banks and global recession.

Worry about paying bills

Of those surveyed, economic anxiety is acutely affecting families on low to medium incomes, with a whopping 88% reporting feeling the brunt of the financial crisis.

Over half of Scots worry about paying bills (54% to a major extent) and six in ten people are worrying about being able to put food on the table (63%). It’s set to be an anxious Christmas for many, with 57% of lower income families saying they have to cut back on family Christmas gifts.

Over a third (36%) have major worries about being able to pay their rent or mortgage and similarly a third of people worry about loans and credit cards (35%). Recent negative headlines mean just under half of Scots are anxious whether their “pensions will be OK” (47%).

Women taking charge

However, adversity also brings out resilience. Almost nine in ten people (87%) are delaying or cutting back on purchases, particularly leisure, dining, clothing, personal care, in addition to the big ticket items like travel, cars, houses.

The data also shows that a significant number of people, especially women, are strategically changing how money gets spent. 80% of women are changing where they shop (some or all of the time), compared to 34% of males, who have not changed where they shop at all.

Similarly 88% of women have switched brands, compared to only 67% of men. Women were also more likely to have switched to more inexpensive brands’. This is a massive change in national shopping behaviours and is sobering news to marketers and retailers, apart from a few clear winners: ASDA, Lidl and Aldi.

Comment

Adam Swann, Chief Strategy Officer, The Union, said:

“This report throws light on the real human impact of the recent economic turbulence. It’s not just about news headlines, it’s millions of people worrying about putting food on the table or not having money to buy gifts at Christmas. It’s also about how a whole nation of people have had to change their spending behaviours to cope, and the role women in particular play in that. It shows how people are adapting to having less money; they are being canny and devising coping mechanisms, women especially”.

“Collectively, this data reveals the biggest change in mass spending and shopping behaviours we’ve seen. And for brands and businesses it should be a wake-up call to really think about how they communicate to people right now, and how to better serve the consumer.? We don’t expect all these behaviours to ever reset, there will be a ‘new normal’. Those businesses and brands that support people now will win preference longer term when the crisis abates.”

For more information and/or a copy of the full report, please contact Ali Liddy on ali.liddy@union.co.uk or enter your email below and we’ll send it directly to you.

About the ‘Mood of the Nation Report’

Commissioned by The Union, in partnership with 56 Degree Insight, the Mood of the Nation research study was in-field 14th-16th October 2022. 1,005 Scottish adults, nationally representative in terms of gender, age, region and socio-economic group participated in the survey.

About The Union

Established 26 years ago, The Union is Scotland’s largest independent integrated marketing agency.? With sales of over £12 million, The Union employs over 85 staff in its Edinburgh offices and works for over 50 clients from its Edinburgh offices in Inverleith Terrace. Key clients include, Scottish Government, Scottish Widows, Zero Waste Scotland, Transport Scotland, The Paint Shed, PODFather, VisitScotland, Hankey Bannister, Historic Scotland, schuh, Scottish Tourism Alliance and Scotland Food & Drink.