Pension Mirror, our interactive tool for Scottish Widows, has just won its tenth major industry award. And it’s racked up a further 8 shortlists, so that’s ten and counting.

What’s its secret? The particular alchemy of age-old insight combined with shiny new technology.

The palm-of-the-hand mobile tool is proving to be a highly effective solution to a great big problem. An ageing population means more funds are required for a longer retirement, and nearly 3 in 5 defined contribution pension savers expected to enter retirement without adequate savings in the next 20 years*. Britain is facing a looming pension crisis.

We know from research that people who check their pensions regularly are able to retire earlier, but before Pension Mirror, the vast majority of Scottish Widows’ pension scheme members hadn’t logged in to see their balance in over a year - if ever. At the root of the problem was apathy, only worsened by cost of living pressures forcing the public to cut back and focus on getting by day-to-day.

So how to break that apathy?

People don’t want to think about pensions. But they do want to know how old they look – and whether they’re doing better or worse than others their age. We harnessed two universal human drivers – vanity and social proof – to draw in an otherwise disengaged audience, provide context to what they discovered via the experience, and motivate them to take action.

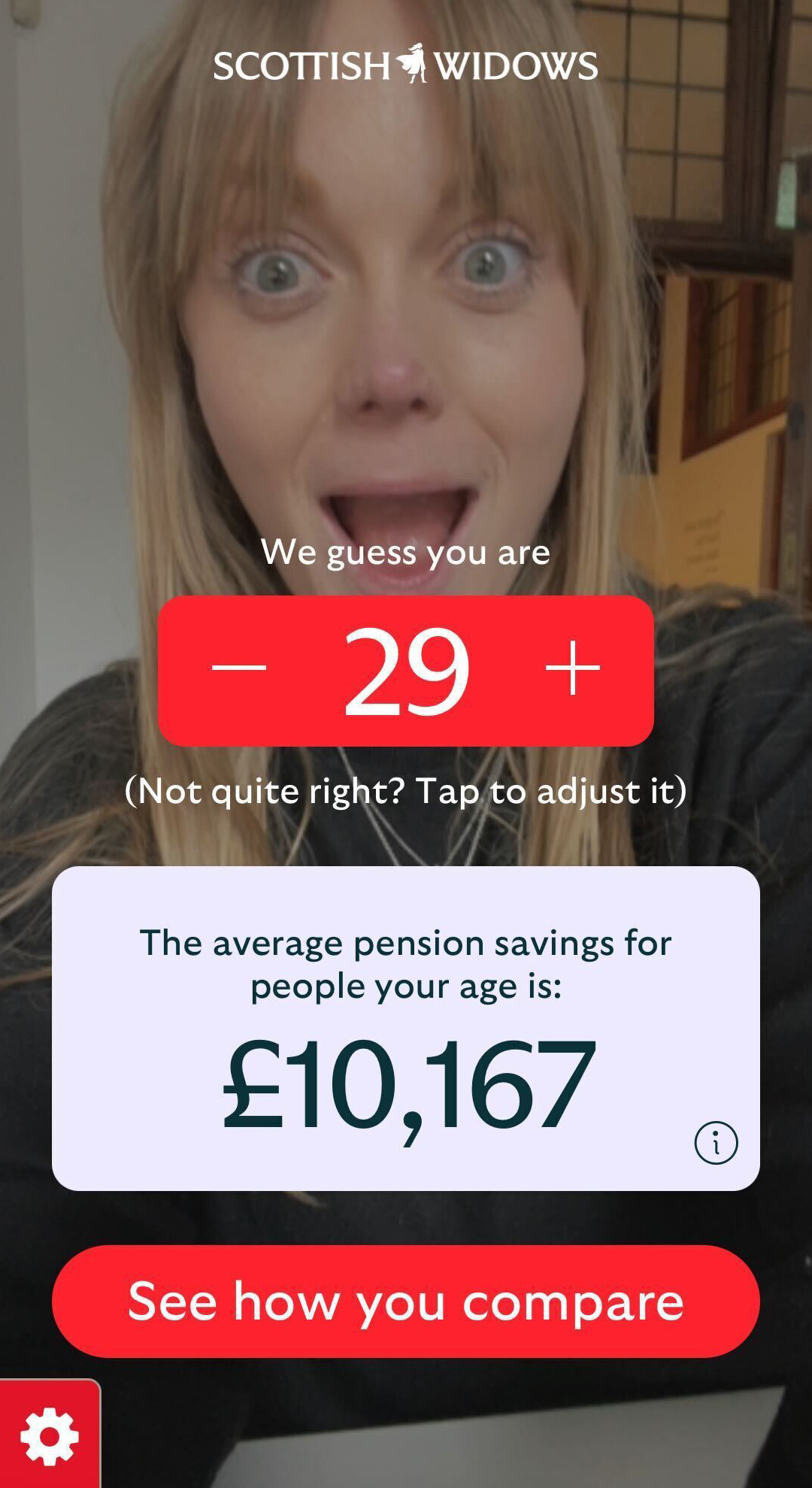

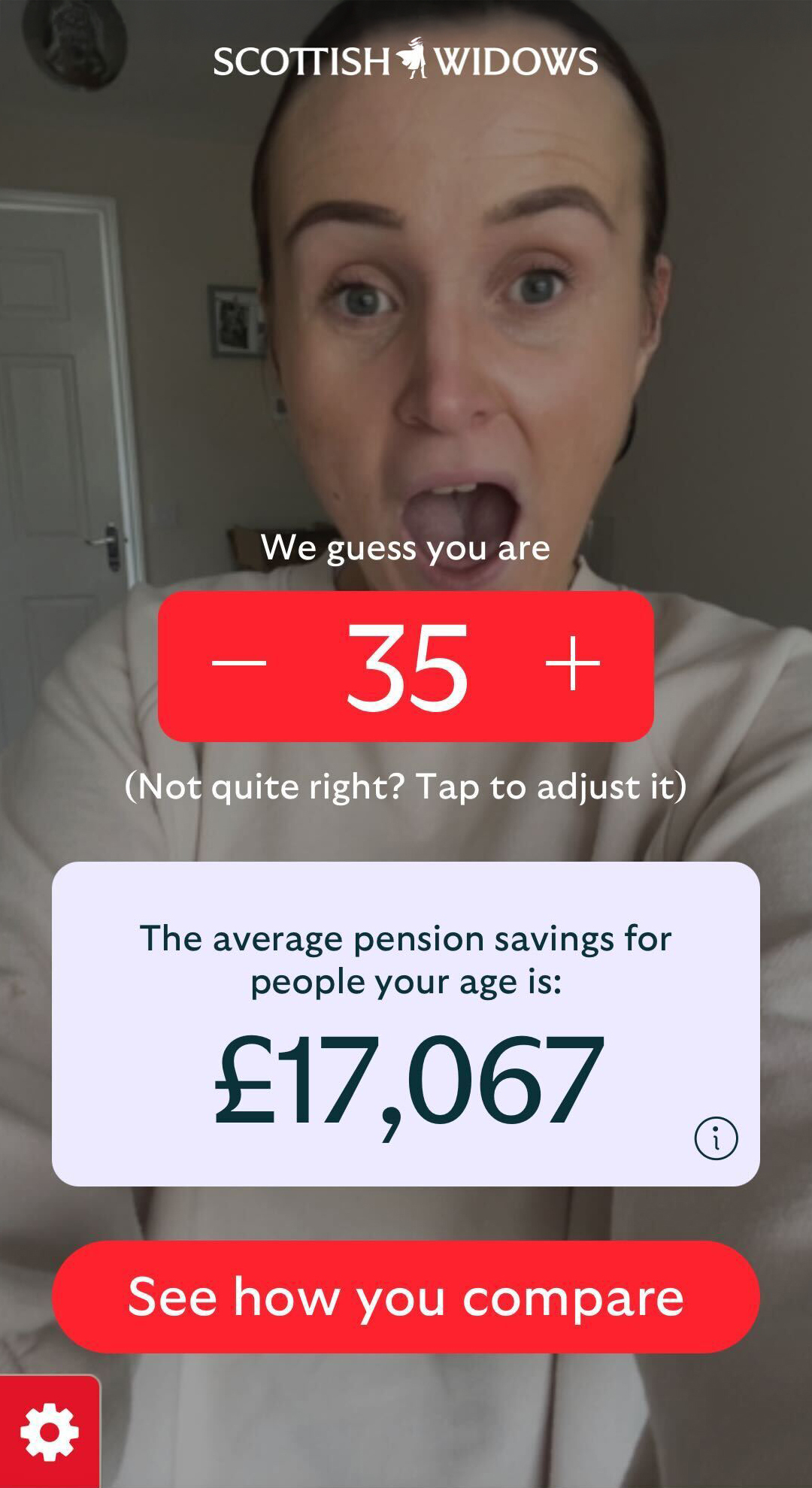

Some happy(ish) reactions to the online Pension Mirror tool!

Pension Mirror scans a user’s face to guess their age, then shows them average pension savings for their age. They can make any corrections to the age shown and are then invited to ‘See how you compare’ by checking their pension in the Scottish Widows app. So far, so straightforward. But behind the easy-peasy user interface is cutting-edge AI facial analysis technology, ONS data and a whole lot of never-been-done-before digital build.

And last October we took it one step further, building a real world, interactive mirror and setting it up at London’s Waterloo station to stop busy commuters in their tracks. Overhead digital screens directed people to the Mirror, while specialist Scottish Widows advisers were on hand to offer support and education. Users could take away a printed photo capturing their reaction to their guessed age, showing average savings and a QR code to download the Scottish Widows app, driving action and shareability beyond the day itself.

Waterloo's commuters were keen to take a look in the Pension Mirror

Besides careful coordination of strategy, budgets and execution, the project required bravery from both client and agency teams. Luckily our client, Scottish Widows’ Susan Robertson, had the vision to get behind Pension Mirror, spurring us on to create something the market had never seen before. She supported us in making the idea a reality in super-quick time, helping jump multiple stakeholder approval and compliance hurdles without losing momentum.

The fairest of them all

It paid off: Pension Mirror has had over 800,000 uses and during the latest campaign burst contributed to a 20% increase in Scottish Widows app downloads. The Waterloo activation lured a steady stream of busy commuters, averaging an interaction every 1 minute 50 seconds from 7am to 8pm. And obviously we’re chuffed with its string of awards from the likes of Campaign, The Drum and Marketing Society. But most importantly, it’s set more young people on the path to a better future.

While its use of AI makes the Pension Mirror story so hot right now, we didn’t set out to use tech for tech’s sake. To quote the IPA’s Nigel Gwilliam from his SXSW Roundup, it’s the “symbiosis” of humans and AI we should all aim for. We humans can do what we do best – that’s empathy and creative thinking – with AI allowing us to execute previously unachievable ideas at speed and relatively low cost. In that sense, AI levels the playing field; benefiting players like us outside the bubbles of London and New York. Mega production budgets we may not always have; inventiveness we certainly do.

*Phoenix Insights with Frontier Economics, October 2024